Argentina año verde...

...digo combustible verde.

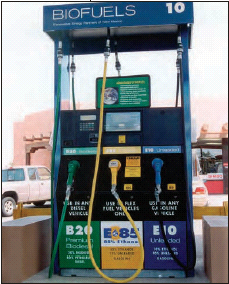

Luego del 2004 (gas) y ahora con el problema del gasoil (muy fuerte, si llegara a llover no sé cómo van a mover las cosechadoras/tractores/sembradoras/etc.) , en breve vamos a comenzar a tener de estas en las estaciones de servicio...

(B20: 20% biodiesel, 80% gasoil; E85: 85% etanol, 15% nafta; E10: ya entendieron, no?).

Bienvenida sean. Generamos una nueva demanda para los commodities, industrializamos en origen, promovemos el desarrollo industrial en el interior, diversificamos la matriz energética, la hacemos más limpia y renovable, exportamos con mayor valor agregado y seremos más lindos.

Otro efecto colateral Impensado (O tal vez no!! Santos Recorcholis, Batman) del control de precios.

Imaginate un mundo paralelo con la nafta a $5 el litro...uffff (no tengo auto asi que en realidad no se si este numero esta bien..pero la idea es (Precio de hoy)*2)

God Bless K!!!

Me dicen expertos que el etanol es un fad sin lógica económica. "Las dos criticas principales son: a)compite contra alimentos y b)consume más energía que la que produce. Por eso, donde hay, está subsidiado aún hoy (en USA, groseramente, en Brasil creo que también y masivamente en sus origenes hasta que la caña cubrió medio Brasil). Pero es fancy y hay regl. en la UE que obligan, pej, a mezclar biodiesel (B-5, o sea 5 %) y crean un mercado inagotable para nuestras incipientes plantas de biodiesel."

A ver si cabe todo este recorte en un "comment":

FINANCIAL TIMES

Ethanol is glamorous but can’t compete with coal

By James Altucher

Published: August 28 2006 16:47 | Last updated: August 28 2006 16:47

In January I wrote an article describing my pick of the year for 2006, which was Rentech, a coal-to-liquids technology company.

It is an American organisation that owns and licenses a proprietary and patented process which converts coal into valuable liquid hydrocarbons. In plain English it takes biomass (coal, natural gas, woodchips etc) and turns it into gas. From the gas state it turns it into liquid fuel (hydrocarbon).

This process, called Fischer-Tropsch, requires no new product delivery infrastructure, produces clean-burning fuels that meet all worldwide standards, produces 42 per cent fewer hydrocarbon emissions and emits almost no sulphur.

My premise was that people would realise this was the true clean, alternative fuel as opposed to the scams being perpetrated by the ethanol and biofuel adherents. So far so good. Rentech is up from $3.90 to about $4.90 but Wall Street is still unaware of it and still beholden to the bubble of ethanol. (Disclosure: I am a long-term investor in Rentech.)

I’m the first to admit that bubbles go hand in hand with innovation. In the 1990s people couldn’t tell if the internet was a bubble or the future of media and commerce. It turns out it was a little bit of both – but only when the right business models are used. The internet turned everything upside down and forced traditional businesses to question whether we were in a “new economy”. It turns out we weren’t, and that the laws of supply and demand are still forces of nature.

The same questions are being flirted with now that oil is $70 and, if we believe Goldman Sachs, heading to $100 and beyond. In a new world where energy is scarce and the Middle East is in more upheaval than ever, the quest for the miracle fuel is creating a bubble of speculation in alternative energy resources that rivals the famous bubble stocks such as Pets.com and TheGlobe.com.

Ethanol and biofuel are glamorous and exciting. You can grow them in your backyard. You can eat it for dinner and then stuff it down your car and drive 1,000 miles. There’s a Norman Rockwell vision of these home-grown fuels that satisfies our primal urge to be independent of the war-torn sources of oil, or the environmentally questionable source found in coal.

But it is coal that solves the problem. First, it will be impossible to grow enough corn and beans to make a real dent in US demand by using ethanol. Last year the US consumed nearly 150bn gallons of gasoline. The national energy bill passed last August mandates production of 7.5bn gallons of ethanol by 2012.

Another critical issue is that ethanol absorbs water but gasoline doesn’t. So ethanol cannot be shipped by petroleum pipelines but must be transported by truck, train, or ship. The infrastructure to do this is expensive and would require changing all our energy shipping infrastructure.

There is another critical feature of ethanol. There’s a huge competing use of ethanol that doesn’t exist with coal. Corn and soybean are food. Coal doesn’t have a competing use. Nor does coal have 1,000 traders hedging their feedstock (or just plain speculating), creating volatility in prices. Coal companies know how much they have and where it is – straight down, as opposed to spread out over thousands of acres whose soil is being depleted each year by the herbicides used on corn. Coal prices are much less volatile because the supply is controlled by a handful of companies.

Perhaps most importantly, it’s unclear that ethanol would make fuel consumption cheaper than oil. Most studies suggest that the process of making a gallon of ethanol uses more than a gallon of fossil fuel, making ethanol more expensive. By contrast, using coal liquefaction techniques, the break-even cost is $25-$35 a barrel of oil.

Fischer-Tropsch was invented in Germany in the 1920s and was used by Germany and Japan in the second world war to produce alternative fuels. (Germany is coal-rich but petrol-poor.) Few companies have commercialised or have patents on Fischer-Tropsch technology.

The main criticism of coal as a fuel is the after-effect of the carbon dioxide on global warming. Typically, carbon dioxide comes out of the process – or in any oil refinery – and just goes into the atmosphere.

However, Rentech says it is designing its plants to be “carbon capture ready” and to be located in areas where the carbon dioxide can be used either commercially in food-grade products (resold to bottle manufacturers or fertiliser makers), used for enhanced oil recovery, and for coal-bed methane production.

While the story so far has played out well, I expect that general awareness of the problems of ethanol will force analysts to look at the real alternative fuels available and that companies such as Rentech will win as a result.

james@formulacapital.com

Ok!

visto estaticamente puede ser cierto. Pero ahora es cuestion de que los muchachos se pongan a investigar al respecto

Escuche en algun telepasillo que la argentina tiene lineas activas de investigacion en ese are ¿Puede ser?

Comentario: La nota dice algo asi como q "la empresa busca soluciones para resolver el problema de la emision de Carbono"...Que se yo, se han tomado sus doscientos años.

La producción de etanol no consume más energía que la que entrega. Eso es cualquiera. Y el proceso coal to liquid lo inventaron unos alemanes hace 80 años, y se uso mucho durante la 2da guerra. Es eficiente, pero tampoco una panacea

Parecería que el asunto no va a funcionar:

http://www.manicore.com/anglais/

documentation_a/carb_agri_a.html

Lo tuve que partir, porque el link entero no me entra en este cuadradito. Habrá que hacer dos veces cut and paste. Pero el artículo es interesante.

sólo leí el título pero ya te adelanto: eso nadie lo propone porque sencillamente se sabe que es totalmente imposible. Pero eso no significa que estos biocombustibles no se desarrollen y tengan un crecimiento importante...y cambia en cierta manera el paradigma.

el futuro: hidrógeno.

Si Abuelo, el futuro es claramente Fuel Cells. Pero la tecnología parece que aún está cruda.

viagra 100mg buy sublingual viagra online buy generic viagra does viagra really work viagra stories women does viagra work can viagra be used by women viagra and hearing loss cialis viagra alternative to viagra viagra australia is viagra safe for women viagra for sale without a prescription effects of viagra