Con la comida no se jode

La célebre frase de Scioli me viene ideal para ilustrar la idea de este post. La FAO (Food and Agriculture Organization of the United Nations), siempre muy atenta a la seguridad alimentaria mundial y el impacto del precio de los alimentos en los países más pobres, ha expresado en su último informe una idea controversial para muchos: la creciente especulación en el mercado de granos no afectó el precio de los alimentos.

Por supuesto no lo dice de ese modo. Veamos sus frases textuales:

Some observers contend that increased participation by speculators in futures markets has increased so markedly in recent years, that it is now excessive and could be a cause of the very recent price gyrations experienced in basic food commodity markets. However it is also probable that their increase reflects expected profit opportunities that originate in the commodity market fundamentals themselves and are signalled to them by hedger activity. Simply put, the increase in speculative activity is due to expected changes in market fundamentals and not vice versa.

...

Some observers do suggest that speculators were responsible in part for recent price rises and not simply to underlying market fundamentals (Robles et al., 2009, Masters, 2008).There is almost no evidence that speculative positions in futures markets directly affect prices, though some have found some evidence over specific intervals for certain commodities. Very preliminary in house econometric analysis also does not indicate any statistical link between speculators positions and spot prices. Other recent studies have found mixed results on directions of causation (EU, 2009). The topic certainly merits further research to avoid a priori judgements in any policy decisions regarding the operation of these markets.

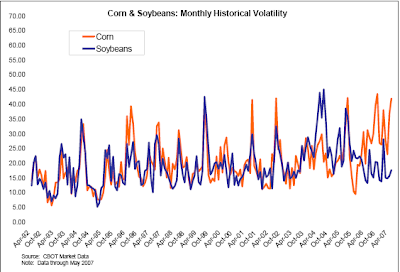

Basta de hablar de fondos y otras macanas por el estilo y volvamos sobre los fundamentals tradicionales.

Fuente: OECD-FAO Agricultural Outlook 2009-2018

Etiquetas: cbot, fao, mercado de capitales, sector agroindustrial